Changes in the contribution bases for the self-employed from October onwards

- 22 September 2022

- Business Consultancy

Next September 30th is the deadline for applying for the modification of the contribution base of the Special Scheme for Self-Employed Workers, as established by Law 6/2017, of October 24th, on Urgent Reforms for Self-Employed Workers. This measure will be effective on the 1st of October 2022, within the permitted limits shown in the table below.

You can request another change before 31 December 2022, and it will be effective on January 1st of 2023.

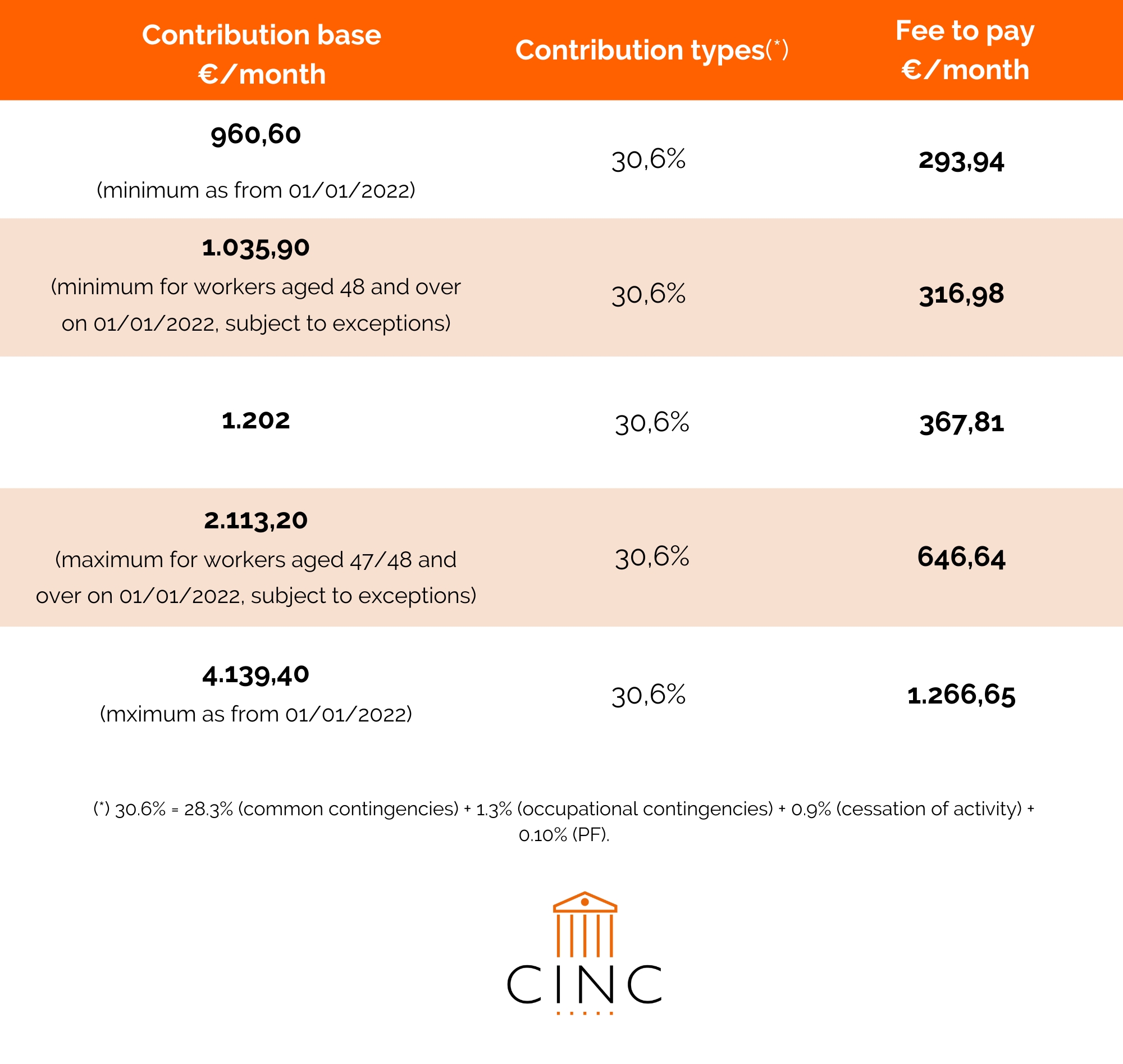

We show, as an example, a comparative table with some options and the current amounts in 2022:

We would like to take this opportunity to remind you that, with the implementation of the new system of contributions based on the real income of self-employed workers, those who are included within the scope of application on the RETA, will be able to change the base on which they are obliged to pay contributions up to six times a year. They will therefore be allowed to choose another one within the minimum and maximum limits applicable to each financial year, if they request this from Social Security, along with a request for a change in their monthly contribution base.

In addition, they must also declare the average monthly net annual income that they expect to earn from their economic or professional activity in the calendar year in which this change of contribution base takes effect.